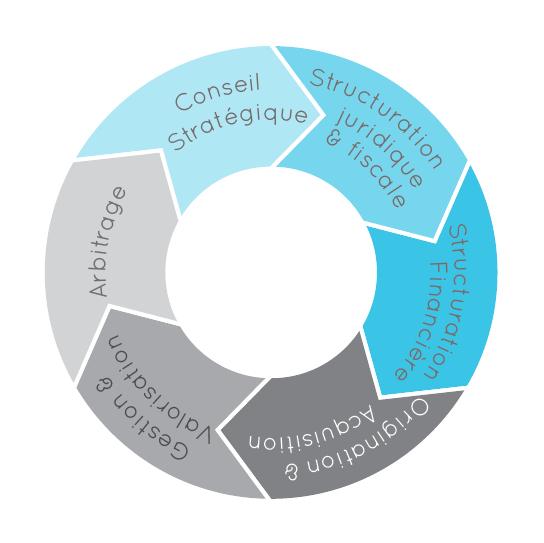

CARYATID AM acts as asset manager and advisor specifically dedicated to real estate business. CARYATID AM is an independent partner owned company. CARYATID AM aims to offer its clients a tailored and comprehensive service in order to initiate and build up a real estate investment position and increase its profitability on a medium to long term basis, and to generate value in all market conditions. In 2014 four partners, sharing the same professional ethics, each one with several years of complementary experience at a high level in real estate business, have decided to put together their know-how. CARYATID AM has thus enlarged the scope of its activity to cover the entire field of its clients’ requirements. CARYATID AM is positioned as an answer to market’s long term tendencies.

Caryatid AM is the result of the joint analysis of its founders. The increasing interest for real estate, often intended as a strictly financial opportunity, has opened the market to new actors (investors, asset managers, advisors…). Due to constant changes in legal and environmental regulations, tax rules, technical and financial solutions, each operation has become ever more complex and particular Real estate investment then requires both a specific knowledge of the context and a proven operational know-how. This is where CARYATID AM steps in to assist and advise its clients, to come out with solutions and follow operations to their end as to maximize investment value.

CARYATID AM has no other interest to take into account than its clients. Every counsel is given on a basis as objective, appropriate and sincere as possible.

CARYATID AM’s analysis covers all the relevant aspects of a deal and investigates all possible solutions or alternatives to achieve its clients’ aim.

CARYATID AM is sized so as to provide distinctive attention to each client through a personal relationship. CARYATID AM is also shaped to put together round the table all the necessary competences for quick and innovative answers.

All CARYATID AM’s partners abide strictly to all international business standards; their professional record testifies their discretion, loyalty and commitment to highest ethical rules.

CARYATID AM offers a global service tailored to your requirements. CARYATID AM provides an all-round analysis of your project and its multiple issues, studies each investment according to your own particular angle, shares with you their widespread experience of previous deals. Most significantly, CARYATID AM stands by your side with the eye of a potential co-investor and will never recommend a strategy which we would not undertake ourselves.

This may turn out to be hazardous for unaccustomed investors, particularly if they are not resident on the spot. CARYATID AM’s team of partners are then able to offer their successful experience in process managing of an external task- force, based on their extensive knowledge of the local professional environment. CARYATID AM proposes to act as your unique agent with responsibility to select, coordinate, survey and control the appropriate contributors to your project. CARYATID AM’s practice of this hub-like organisation explains how a voluntarily restricted and complementary team of partners may provide whenever necessary a comprehensive “all-included” service. And in the same time, the means employed in each case may be strictly adjusted to the needs. CARYATID AM’s offer gives you full hand over your investment which you can manage as a “private account” whereas the usual mutual fund type of real estate investment allows in practice very little to no control of the way business is conducted. Our detailed scrutiny of all the issues involved is naturally capable of taking into account non-financial considerations such as socially responsible investment and sustainable growth, …

CARYATID AM is able to help define a strategy or set up the financial structure: complex development problems organisational issues analysis and optimization of operating performance. The strategies we can plan out and conduct are meant to improve the return on investment, provide adequate financing in keeping with your objective of growth, but may also consist in finding paths towards further development. CARYATID AM expects thus to establish and keep up a long lasting partnership with its clients. In order to preserve each client’s interest and maintain its own original approach and critical eye on each opportunity CARYATID AM’s intervention is never bound to the implementation of any one specific deal.

CARYATID AM know-how is based on real estate experienced experts with a sound and successful track record. CARYATID AM’s key people are recognised for their professionalism, ethics, network maintaining first class close relationship with clients.

Partner

Partner

Partner